ARYA FINANCE

Arya Finance

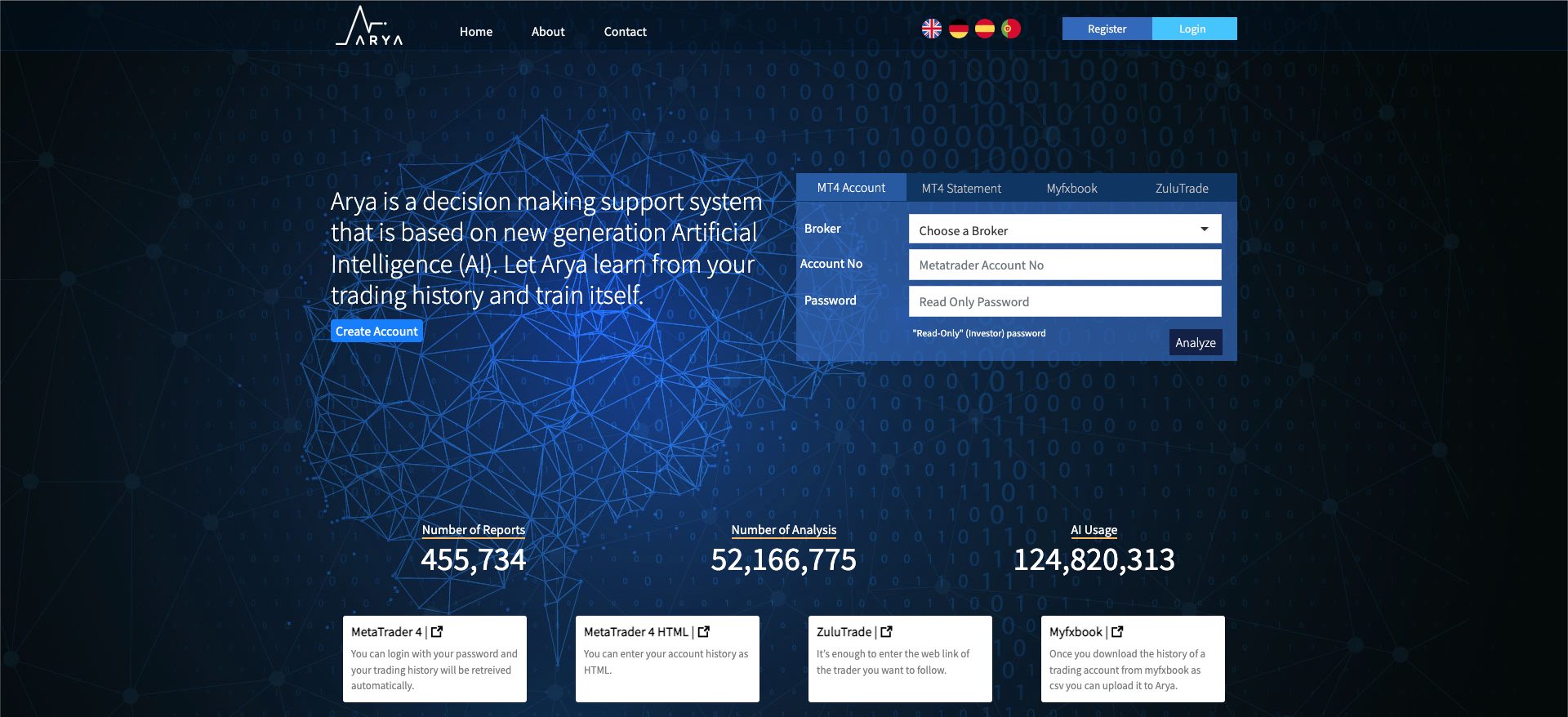

Arya is a decision making support system that is based on new generation Artificial Intelligence (AI). Arya learns from your trading history and trains itself to determine certain market conditions or the trades that are being executed profitably and warns traders for the probability of what they are about to be facing while a new trade is being set. It averts the risk of opening a losing trade and decreases traders’ losses and increases their profit overall as a result.

Traders can use Arya to optimize the performance of their manual trading or the automated systems such as indicators or expert advisors. Since traders want to be assured of the performance of automated trading robots or copy a trader before they buy, Arya helps traders to decide which robot, signal service or trader they need to use or copy.

Arya does not only minimize the risk of their own traders but also analyze the risk of ready-made systems such as the ones in Zulutrade and Myfxbook. Traders can redefine the lot size of your trades along with maximizing their profit by using Arya’s Monte Carlo Simulation and Modern Portfolio Analysis sections. By means of our ‘What If’ section, they are able to analyze the scenarios such as how it would end up if you would trade in a New York session or execute sell orders only. Traders are able to reevaluate with different scenarios.

Arya Trade serves their customers to help them learn the results of their actions and the breakdowns via ‘Decision Tree’ as well as evaluating the quality of the opening and closing decisions of their trades and decide how stressful their trades would be by using ‘Stress and Comfortability Analysis’.

Traders can access the entire artificial intelligence models that they have created at the website with the MetaTrader Expert Advisor Extension or they can send their account history from MetaTrader 4 to Arya Finance website, where they can make analysis and design business intelligence models.

Thanks to Arya Finance’s Smart Copy tools, market conditions are determined before a trader's entry. It analyzes the trading history of the account traders follow and determines the right market conditions according to it. It copies the trade if the market conditions are suitable and rejects if not. So, it minimizes risks while increasing profits.

#Big data, #AI, #Deep Learning, #Python, #C#, #Java, #Fintech, #Price prediction, #Machine Learning, #Genetic Algorithm.